The report shows that in order to keep up with the continuous growth of chip demand, the global semiconductor m

vilsion, Jun, 27, 2024

vilsion, Jun, 27, 2024

— The report shows that in order to keep up with the continuous growth of chip demand, the global semiconductor manufacturing industry is expected to increase production capacity by 6% in 2024 and 7% in 2025, reaching a historical high of 33.7 million wafers per month (wpm: 8 inch equivalent, the same below).

In 2024, the cutting-edge production capacity of nodes 5 nanometers and below is expected to increase by 13%, mainly driven by Generative Artificial Intelligence (AI) for data center training, inference, and cutting-edge equipment. In order to improve processing energy efficiency, chip manufacturers including Intel, Samsung, and TSMC are preparing to start producing 2nm full gat...

The global semiconductor industry is expected to recover in 2024 and move towards a record income of 1 trillion

vilsion, May, 27, 2024

vilsion, May, 27, 2024

— The global semiconductor industry is expected to recover in 2024 and move towards a record income of 1 trillion US dollars. Its prospect is very bright, and behind it is unprecedented growth momentum, market opportunities and technological progress. However, with the record greenfield capital investment and government-supported regional capacity expansion, the global semiconductor manufacturing industry still needs to overcome the long-standing headwinds in the next few years.

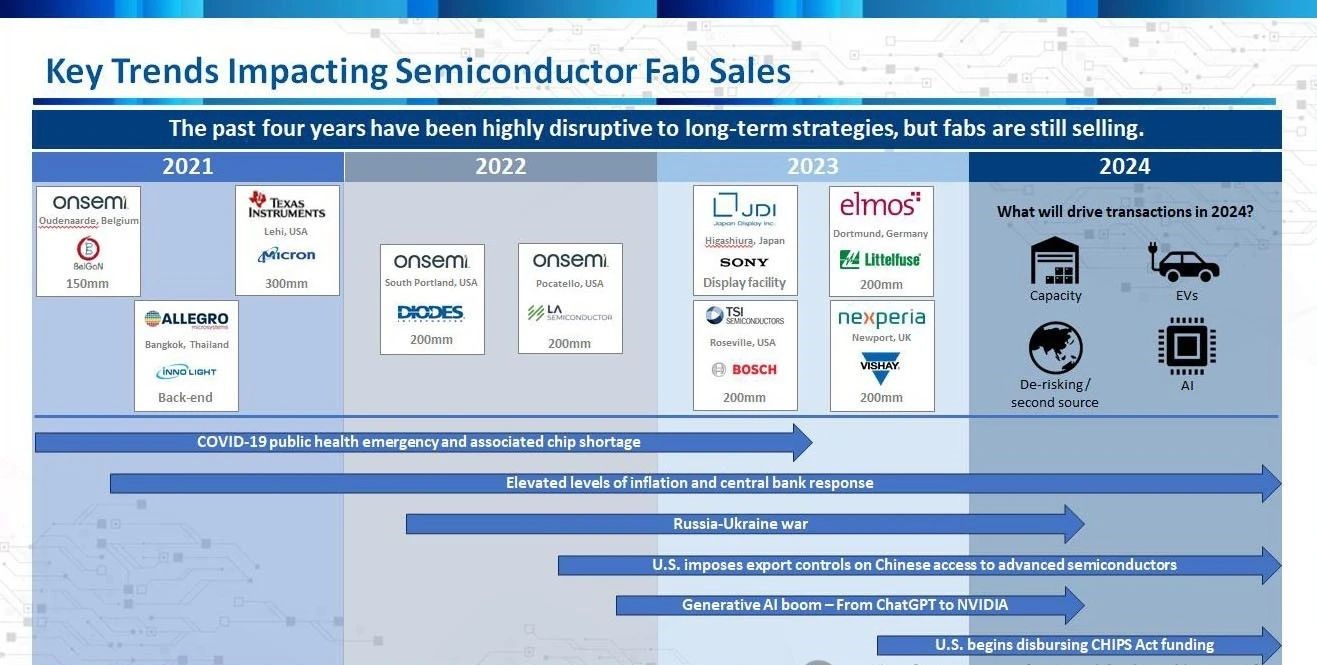

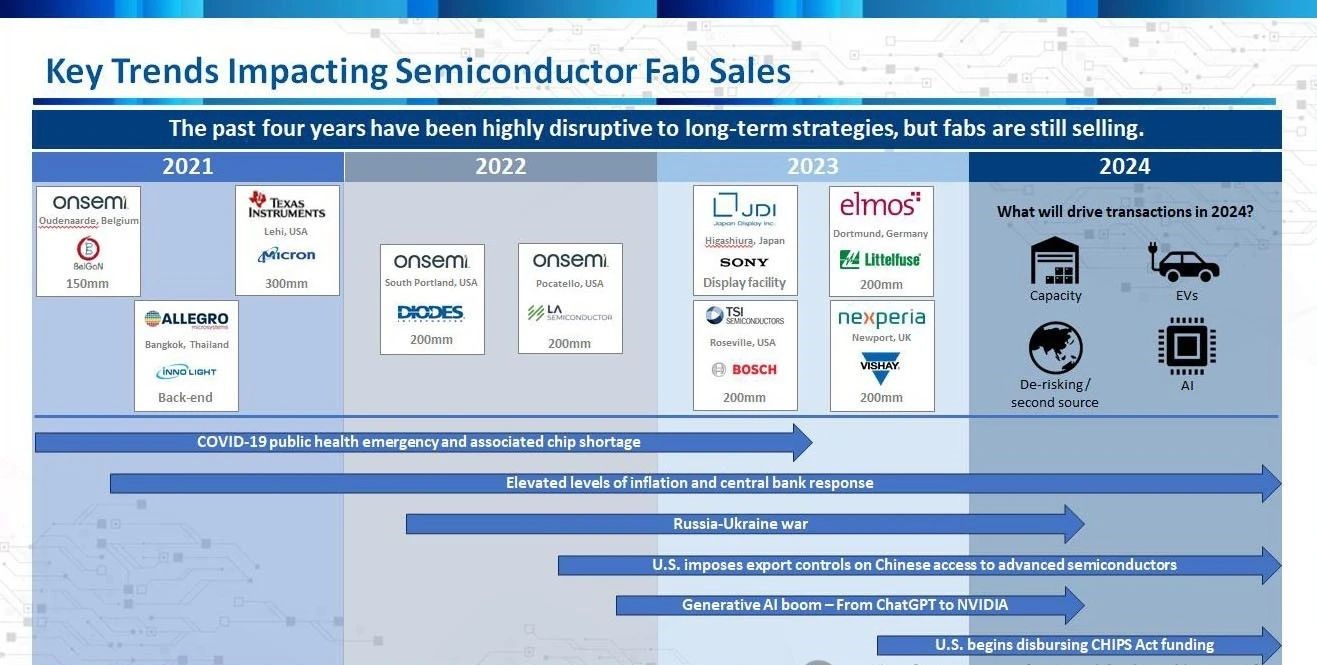

Tracking the global wafer fab exchange is an effective method to predict the trend of the global semiconductor industry. As can be seen from the following figure, the past four years have been particularly turbulent, and many unforeseen world events have occurred, forcing enterprises to adjust their long-term manufacturing strategies.

vilsion, Jun, 27, 2024

— The report shows that in order to keep up with the continuous growth of chip demand, the global semiconductor manufacturing industry is expected to increase production capacity by 6% in 2024 and 7% in 2025, reaching a historical high of 33.7 million wafers per month (wpm: 8 inch equivalent, the same below).

In 2024, the cutting-edge production capacity of nodes 5 nanometers and below is expected to increase by 13%, mainly driven by Generative Artificial Intelligence (AI) for data center training, inference, and cutting-edge equipment. In order to improve processing energy efficiency, chip manufacturers including Intel, Samsung, and TSMC are preparing to start producing 2nm full gat...

vilsion, Jun, 27, 2024

— The report shows that in order to keep up with the continuous growth of chip demand, the global semiconductor manufacturing industry is expected to increase production capacity by 6% in 2024 and 7% in 2025, reaching a historical high of 33.7 million wafers per month (wpm: 8 inch equivalent, the same below).

In 2024, the cutting-edge production capacity of nodes 5 nanometers and below is expected to increase by 13%, mainly driven by Generative Artificial Intelligence (AI) for data center training, inference, and cutting-edge equipment. In order to improve processing energy efficiency, chip manufacturers including Intel, Samsung, and TSMC are preparing to start producing 2nm full gat...

vilsion, May, 27, 2024

— The global semiconductor industry is expected to recover in 2024 and move towards a record income of 1 trillion US dollars. Its prospect is very bright, and behind it is unprecedented growth momentum, market opportunities and technological progress. However, with the record greenfield capital investment and government-supported regional capacity expansion, the global semiconductor manufacturing industry still needs to overcome the long-standing headwinds in the next few years.

Tracking the global wafer fab exchange is an effective method to predict the trend of the global semiconductor industry. As can be seen from the following figure, the past four years have been particularly turbulent, and many unforeseen world events have occurred, forcing enterprises to adjust their long-term manufacturing strategies.

vilsion, May, 27, 2024

— The global semiconductor industry is expected to recover in 2024 and move towards a record income of 1 trillion US dollars. Its prospect is very bright, and behind it is unprecedented growth momentum, market opportunities and technological progress. However, with the record greenfield capital investment and government-supported regional capacity expansion, the global semiconductor manufacturing industry still needs to overcome the long-standing headwinds in the next few years.

Tracking the global wafer fab exchange is an effective method to predict the trend of the global semiconductor industry. As can be seen from the following figure, the past four years have been particularly turbulent, and many unforeseen world events have occurred, forcing enterprises to adjust their long-term manufacturing strategies.