DRAM, NAND drive first annual double-digit upturn

The expected 16% increase will be the first double-digit gain for the IC market since it expanded by 33% in 2010 and the fifth double-digit increase for the IC market since 2000.

Due to the exceptional growth in the DRAM and NAND flash memory markets, market research firm IC Insights has revised its outlook and analysis of the IC industry for the last six months of 2017.

Entering the second half of the year, it is clear the IC industry is on course for a much stronger upturn than was initially forecast in January. IC Insights now expects the IC market to increase 16% in 2017, while the DRAM market is forecast to grow 55% and the NAND flash market is expected to rise 35% this year—in both cases, almost entirely due to fast-rising prices rather than unit growth.

Excluding these two markets, the overall IC market growth is forecast to show just 6% year-over-year growth. The expected 16% increase would be the first double-digit gain for the IC market since it expanded by 33% in 2010—the recession-recovery year—and the fifth double-digit increase for the IC market since 2000.

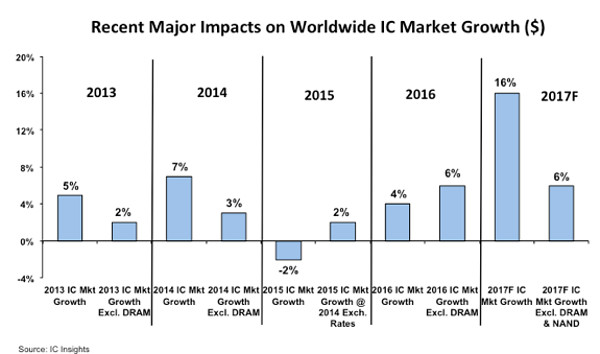

Figure 1: Excluding DRAM and NAND flash memory markets, the overall IC market growth is forecast to show just 6% year-over-year growth. (Source: IC Insights)

As seen in the figure, the DRAM market has had a notable impact on total IC market growth in recent years. With market surges of 32% and 34% in 2013 and 2014, respectively, the DRAM market alone boosted the worldwide IC market growth rate by three percentage points in 2013 and four percentage points in 2014.

At $64.2 billion, the DRAM market is forecast to be by far the largest single product category in the IC industry in 2017, exceeding the expected second-ranked MPU market for standard PCs and servers ($47.1 billion) by $17.1 billion this year.

Overall, IC Insights’ global economic outlook remains on course with initial projections covered in The McClean Report. Electronic system production, capital spending as a per cent of sales and IC wafer capacity added were unchanged from the original outlook. However, other factors and conditions that contribute to the forecast were upgraded slightly in the mid-year update, according to the firm. For example, the worldwide GDP forecast was upgraded by 0.1 point to 2.7% for 2017, marginally ahead of what is considered to be the global recession threshold of 2.5% growth. IC Insights believes that through the forecast period, annual IC market growth rates will closely track with the performance of worldwide GDP growth.

Meanwhile, China's 2017 GDP was raised to 6.8% for 2017 from the original forecast of 6.3%, following a fairly strong first half of growth. IC Insights also upgraded its U.S. GDP forecast to 2.1% from 2.0% in January.

While the U.S. economy is far from perfect, it is currently one of the most significant positive driving forces in the worldwide economy. Analysts said falling unemployment rate, PMI figures of 57.0 and 55.8 in the first and second quarters of this year and relatively low oil prices should help the U.S. economy sustain its modest growth in the second half of this year. Growth rates for IC unit shipments, IC average selling price, and semiconductor capital spending were also revised slightly higher.

Due to the exceptional growth in the DRAM and NAND flash memory markets, market research firm IC Insights has revised its outlook and analysis of the IC industry for the last six months of 2017.

Entering the second half of the year, it is clear the IC industry is on course for a much stronger upturn than was initially forecast in January. IC Insights now expects the IC market to increase 16% in 2017, while the DRAM market is forecast to grow 55% and the NAND flash market is expected to rise 35% this year—in both cases, almost entirely due to fast-rising prices rather than unit growth.

Excluding these two markets, the overall IC market growth is forecast to show just 6% year-over-year growth. The expected 16% increase would be the first double-digit gain for the IC market since it expanded by 33% in 2010—the recession-recovery year—and the fifth double-digit increase for the IC market since 2000.

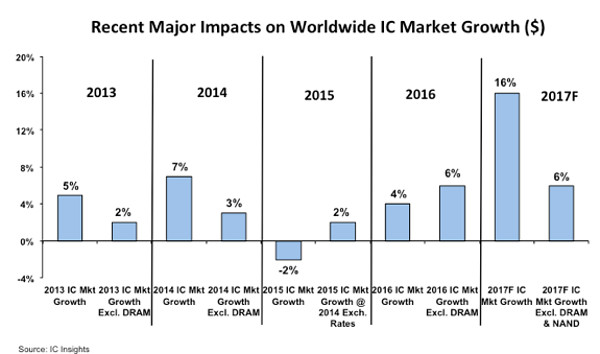

Figure 1: Excluding DRAM and NAND flash memory markets, the overall IC market growth is forecast to show just 6% year-over-year growth. (Source: IC Insights)

As seen in the figure, the DRAM market has had a notable impact on total IC market growth in recent years. With market surges of 32% and 34% in 2013 and 2014, respectively, the DRAM market alone boosted the worldwide IC market growth rate by three percentage points in 2013 and four percentage points in 2014.

At $64.2 billion, the DRAM market is forecast to be by far the largest single product category in the IC industry in 2017, exceeding the expected second-ranked MPU market for standard PCs and servers ($47.1 billion) by $17.1 billion this year.

Overall, IC Insights’ global economic outlook remains on course with initial projections covered in The McClean Report. Electronic system production, capital spending as a per cent of sales and IC wafer capacity added were unchanged from the original outlook. However, other factors and conditions that contribute to the forecast were upgraded slightly in the mid-year update, according to the firm. For example, the worldwide GDP forecast was upgraded by 0.1 point to 2.7% for 2017, marginally ahead of what is considered to be the global recession threshold of 2.5% growth. IC Insights believes that through the forecast period, annual IC market growth rates will closely track with the performance of worldwide GDP growth.

Meanwhile, China's 2017 GDP was raised to 6.8% for 2017 from the original forecast of 6.3%, following a fairly strong first half of growth. IC Insights also upgraded its U.S. GDP forecast to 2.1% from 2.0% in January.

While the U.S. economy is far from perfect, it is currently one of the most significant positive driving forces in the worldwide economy. Analysts said falling unemployment rate, PMI figures of 57.0 and 55.8 in the first and second quarters of this year and relatively low oil prices should help the U.S. economy sustain its modest growth in the second half of this year. Growth rates for IC unit shipments, IC average selling price, and semiconductor capital spending were also revised slightly higher.

CONTACT US

USA

Vilsion Technology Inc.

36S 18th AVE Suite A,Brington,Colorado 80601,

United States

E-mail:sales@vilsion.com

Europe

Memeler Strasse 30 Haan,D 42781Germany

E-mail:sales@vilsion.com

Middle Eastern

Zarchin 10St.Raanana,43662 Israel

Zarchin 10St.Raanana,43662 Israel

E-mail:peter@vilsion.com

African

65 Oude Kaap, Estates Cnr, Elm & Poplar Streets

Dowerglen,1609 South Africa

E-mail:amy@vilsion.com

Asian

583 Orchard Road, #19-01 Forum,Singapore,

238884 Singapore

238884 Singapore

E-mail:steven@vilsion.com