An ice-fire semiconductor equipment market

The epidemic has brought many challenges to the semiconductor industry. The most representative one is the smartphone chip industry, which has suffered a great impact. In the past six months, the performance of related manufacturers has been suppressed.

However, the epidemic has brought opportunities to the semiconductor manufacturing industry. The revenue and stock prices of major foundries have been rising, and this momentum is likely to continue, at least until next year. Due to the boom in the manufacturing industry, the rising tide has driven upstream semiconductor equipment. Judging from the statistics of SEMI in recent months, the global semiconductor equipment manufacturers, especially those in North America, have shown an upward trend in their revenue performance with gratifying results.

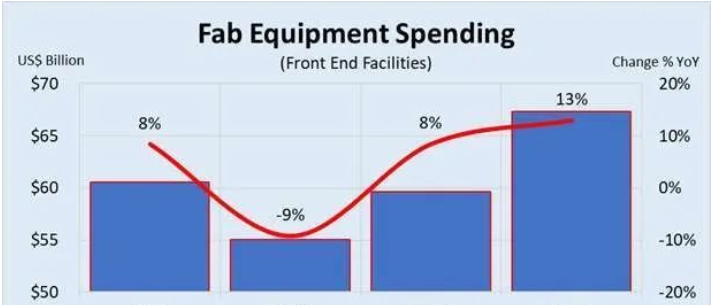

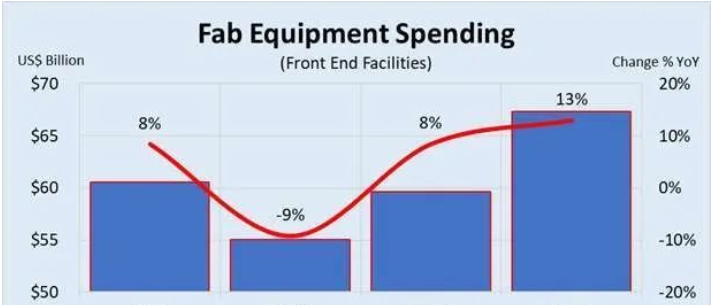

SEMI said that the epidemic has increased the market's demand for application chips such as IT infrastructure, personal cloud computing, games and medical electronic devices, thereby pushing up the equipment expenditures of global fabs. It is estimated that the global semiconductor equipment market will increase by 8% this year. %, and the estimated figure of SEMI in July is an annual increase of 6%. It can be seen that the overall development of the industry is better than expected. By 2021, the growth rate is expected to further increase to 13%.

Foundry is the main driver of the gratifying semiconductor equipment market this year. It is estimated that investment will increase by 12% annually to reach US$23.2 billion, and will increase slightly by 2% in 2021.

In the field of product segmentation, memory-related investment is estimated to increase by 16% this year, with total expenditure reaching 26.4 billion US dollars. It is expected to increase by 18% to 31.2 billion US dollars in 2021. Among them, 3D NAND has the largest increase this year, reaching 39% in 2021. The growth trend has slowed down, but it is still expected to reach 7%. Due to the slowdown in investment in the second half of the year, DRAM is expected to grow by 4% for the whole year, and is expected to grow by 39% in 2021.

Another major driving force is the use of advanced process technology logic chips, the main contribution is still the industry's top three, TSMC, Samsung and Intel, their most advanced 10nm, 7nm and 5nm process products have entered the stage of mass production, The demand for the most advanced equipment is very strong, and the price of this part of the equipment is very expensive, so that its scale accounts for a large proportion of the entire semiconductor equipment market.

In addition, the demand for analog chips has been strong, especially for CMOS image sensors (CIS), which is estimated to increase by 60% year-on-year this year, and related equipment expenditure is estimated to increase by 4% this year, and it is expected to increase by 11% in 2021, reaching 34%. One hundred million U.S. dollars. Investment in analog-to-digital mixed-signal and power device manufacturing equipment is also very strong, which is expected to grow by 48% this year.

As for packaging equipment, benefiting from advanced packaging technology and capacity demand, capital support is expected to reach US$3.2 billion in 2020, an annual increase of 10%, and it will reach US$3.4 billion in 2021, an increase of 8% year-on-year. This year, the growth rate of the test equipment market is equally impressive, reaching US$5.7 billion, an annual increase of 13%.

Since the US semiconductor equipment manufacturers are the dominant force in the global market, followed by Japan and Europe, the strong growth of these types of chips will definitely be given to Lam Research, KLA, and Applied Materials (AMAT). ) American companies represented by the top three, as well as ASML in Europe and TEL in Tokyo, Japan have brought huge financial resources.

However, the epidemic has brought opportunities to the semiconductor manufacturing industry. The revenue and stock prices of major foundries have been rising, and this momentum is likely to continue, at least until next year. Due to the boom in the manufacturing industry, the rising tide has driven upstream semiconductor equipment. Judging from the statistics of SEMI in recent months, the global semiconductor equipment manufacturers, especially those in North America, have shown an upward trend in their revenue performance with gratifying results.

SEMI said that the epidemic has increased the market's demand for application chips such as IT infrastructure, personal cloud computing, games and medical electronic devices, thereby pushing up the equipment expenditures of global fabs. It is estimated that the global semiconductor equipment market will increase by 8% this year. %, and the estimated figure of SEMI in July is an annual increase of 6%. It can be seen that the overall development of the industry is better than expected. By 2021, the growth rate is expected to further increase to 13%.

Foundry is the main driver of the gratifying semiconductor equipment market this year. It is estimated that investment will increase by 12% annually to reach US$23.2 billion, and will increase slightly by 2% in 2021.

In the field of product segmentation, memory-related investment is estimated to increase by 16% this year, with total expenditure reaching 26.4 billion US dollars. It is expected to increase by 18% to 31.2 billion US dollars in 2021. Among them, 3D NAND has the largest increase this year, reaching 39% in 2021. The growth trend has slowed down, but it is still expected to reach 7%. Due to the slowdown in investment in the second half of the year, DRAM is expected to grow by 4% for the whole year, and is expected to grow by 39% in 2021.

Another major driving force is the use of advanced process technology logic chips, the main contribution is still the industry's top three, TSMC, Samsung and Intel, their most advanced 10nm, 7nm and 5nm process products have entered the stage of mass production, The demand for the most advanced equipment is very strong, and the price of this part of the equipment is very expensive, so that its scale accounts for a large proportion of the entire semiconductor equipment market.

In addition, the demand for analog chips has been strong, especially for CMOS image sensors (CIS), which is estimated to increase by 60% year-on-year this year, and related equipment expenditure is estimated to increase by 4% this year, and it is expected to increase by 11% in 2021, reaching 34%. One hundred million U.S. dollars. Investment in analog-to-digital mixed-signal and power device manufacturing equipment is also very strong, which is expected to grow by 48% this year.

As for packaging equipment, benefiting from advanced packaging technology and capacity demand, capital support is expected to reach US$3.2 billion in 2020, an annual increase of 10%, and it will reach US$3.4 billion in 2021, an increase of 8% year-on-year. This year, the growth rate of the test equipment market is equally impressive, reaching US$5.7 billion, an annual increase of 13%.

Since the US semiconductor equipment manufacturers are the dominant force in the global market, followed by Japan and Europe, the strong growth of these types of chips will definitely be given to Lam Research, KLA, and Applied Materials (AMAT). ) American companies represented by the top three, as well as ASML in Europe and TEL in Tokyo, Japan have brought huge financial resources.

CONTACT US

USA

Vilsion Technology Inc.

36S 18th AVE Suite A,Brington,Colorado 80601,

United States

E-mail:sales@vilsion.com

Europe

Memeler Strasse 30 Haan,D 42781Germany

E-mail:sales@vilsion.com

Middle Eastern

Zarchin 10St.Raanana,43662 Israel

Zarchin 10St.Raanana,43662 Israel

E-mail:peter@vilsion.com

African

65 Oude Kaap, Estates Cnr, Elm & Poplar Streets

Dowerglen,1609 South Africa

E-mail:amy@vilsion.com

Asian

583 Orchard Road, #19-01 Forum,Singapore,

238884 Singapore

238884 Singapore

E-mail:steven@vilsion.com