2019 semiconductor market plummets, but Intel shines

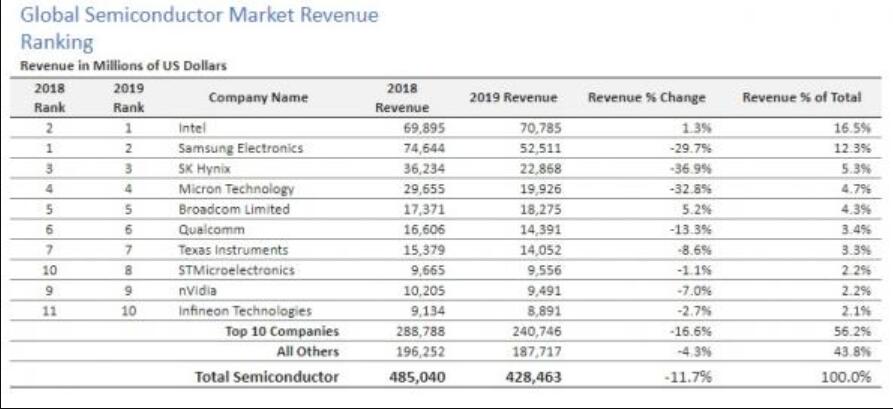

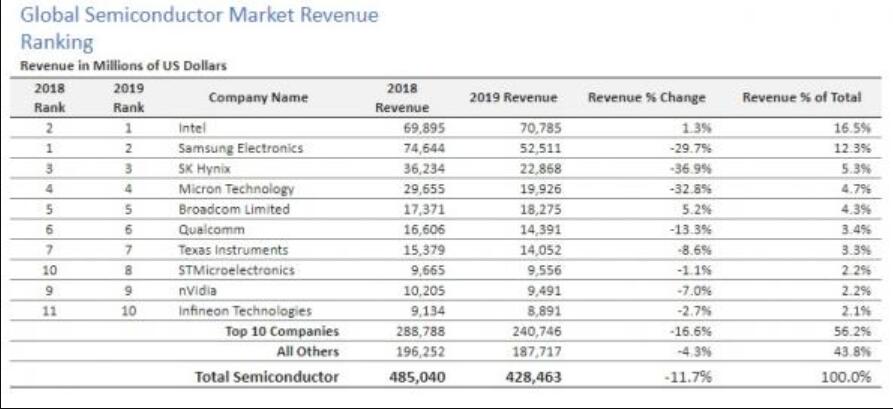

New Omdia research 2019 claims global semiconductor revenue fell by 11.7% in 2019 - the greatest percentage in at least two decades.

Sales fell for every application market and for every global region and eight of the leading ten manufacturers suffered losses during the year.

Global semiconductor revenue in 2019 shed $56.6 billion worth of revenue over the previous year. This represented the most notable drop since 2009, when revenue dropped by 10.9 percent.

The brunt of the fall was felt by semiconductor suppliers in the memory segment, with Samsung Electronics, SK Hynix and Micron Technology all posting revenue declines in about the 30 percent range.

Intel was one of the few companies that bucked that trend by growing and reclaiming the number one position. The company achieved 1.3 percent growth, allowing it to pass Samsung as the world’s top semiconductor supplier in 2019. Intel’s growth represents the payoff for a diversification strategy that’s five years in the making. The company had zero growth in its core microprocessor business, but did well in other areas. For example, sales of logic chips rose 7.1 percent.

Highlights from a year of lows

• Memory chip revenue dropped by 31.6%, with DRAM falling 37.2% and NAND flash memory dropping by 24.5%—despite a stabilization in pricing in the fourth quarter.

• The wireless communications segment fell by 13.3% for the year. Mobile sales declined for the year as consumers delayed phone purchases.

• Artificial-intelligence chipmakers suffered a 7% revenue decline for the year.

Sales fell for every application market and for every global region and eight of the leading ten manufacturers suffered losses during the year.

Global semiconductor revenue in 2019 shed $56.6 billion worth of revenue over the previous year. This represented the most notable drop since 2009, when revenue dropped by 10.9 percent.

The brunt of the fall was felt by semiconductor suppliers in the memory segment, with Samsung Electronics, SK Hynix and Micron Technology all posting revenue declines in about the 30 percent range.

Intel was one of the few companies that bucked that trend by growing and reclaiming the number one position. The company achieved 1.3 percent growth, allowing it to pass Samsung as the world’s top semiconductor supplier in 2019. Intel’s growth represents the payoff for a diversification strategy that’s five years in the making. The company had zero growth in its core microprocessor business, but did well in other areas. For example, sales of logic chips rose 7.1 percent.

Highlights from a year of lows

• Memory chip revenue dropped by 31.6%, with DRAM falling 37.2% and NAND flash memory dropping by 24.5%—despite a stabilization in pricing in the fourth quarter.

• The wireless communications segment fell by 13.3% for the year. Mobile sales declined for the year as consumers delayed phone purchases.

• Artificial-intelligence chipmakers suffered a 7% revenue decline for the year.

CONTACT US

USA

Vilsion Technology Inc.

36S 18th AVE Suite A,Brington,Colorado 80601,

United States

E-mail:sales@vilsion.com

Europe

Memeler Strasse 30 Haan,D 42781Germany

E-mail:sales@vilsion.com

Middle Eastern

Zarchin 10St.Raanana,43662 Israel

Zarchin 10St.Raanana,43662 Israel

E-mail:peter@vilsion.com

African

65 Oude Kaap, Estates Cnr, Elm & Poplar Streets

Dowerglen,1609 South Africa

E-mail:amy@vilsion.com

Asian

583 Orchard Road, #19-01 Forum,Singapore,

238884 Singapore

238884 Singapore

E-mail:steven@vilsion.com