German component distribution sales fall thanks to Brexit

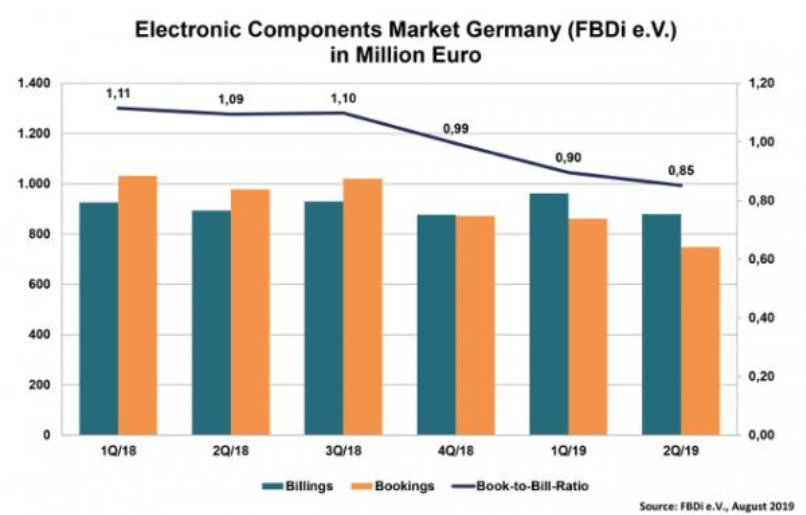

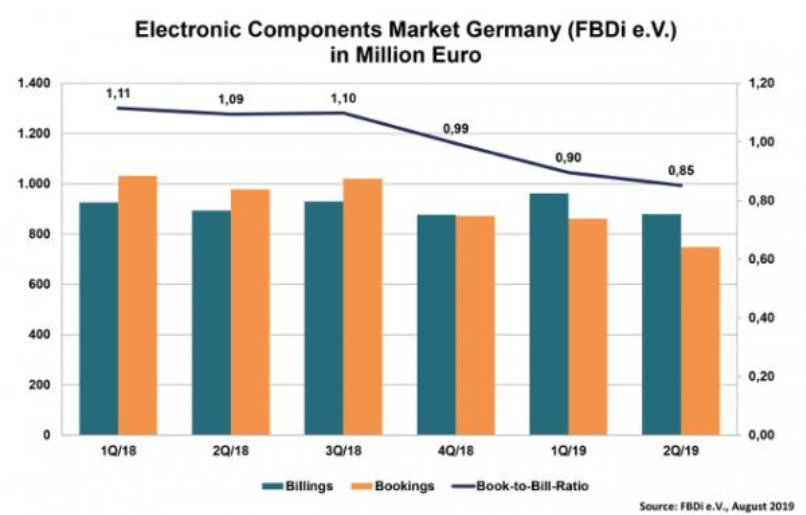

Sales of electronic components through distribution in Germany fell by 2 percent in 2Q19 and the order situation remains poor, according to the Fachverband Bauelemente-Distribution (FBDi eV) organization.

The book-to-bill ratio and bookings have been falling since the 3Q18. In 2Q19 sales under to members under the FBDi umbrella dropped by 2 percent €879 million. In the same quarters orders weakened to around €748 million, equating to a book-to-bill ratio of 0.85.

Georg Steinberger, FBDi chairman of the board, attributed the situation to the general uncertainty caused by Brexit, controversy in customs and other macroeconomic distortions as well as some longer term "hard realities" such as climate change and the end of throwaway society.

By products segment semiconductors and passives remained close to the previous year's levels at €623 million and €112 million, respectively.Electromechanics dropped by 12 percent to €91 million, power supplies dropped by 7 percent to €26 million.The smaller product segments (displays, assemblies and devices) also declined, although sensors grew by 22 percent.Semiconductors held a 70 percent marketshare, passive components 13 percent, electromechanics 11 percent and all other segments combined to 6 percent.

"On a long term, I am convinced that only sustainable technology and innovation can contribute to a macrosocial solution. This is a big challenge, but offers huge potential for our industry," said Steinberger.

The book-to-bill ratio and bookings have been falling since the 3Q18. In 2Q19 sales under to members under the FBDi umbrella dropped by 2 percent €879 million. In the same quarters orders weakened to around €748 million, equating to a book-to-bill ratio of 0.85.

Georg Steinberger, FBDi chairman of the board, attributed the situation to the general uncertainty caused by Brexit, controversy in customs and other macroeconomic distortions as well as some longer term "hard realities" such as climate change and the end of throwaway society.

By products segment semiconductors and passives remained close to the previous year's levels at €623 million and €112 million, respectively.Electromechanics dropped by 12 percent to €91 million, power supplies dropped by 7 percent to €26 million.The smaller product segments (displays, assemblies and devices) also declined, although sensors grew by 22 percent.Semiconductors held a 70 percent marketshare, passive components 13 percent, electromechanics 11 percent and all other segments combined to 6 percent.

"On a long term, I am convinced that only sustainable technology and innovation can contribute to a macrosocial solution. This is a big challenge, but offers huge potential for our industry," said Steinberger.

CONTACT US

USA

Vilsion Technology Inc.

36S 18th AVE Suite A,Brington,Colorado 80601,

United States

E-mail:sales@vilsion.com

Europe

Memeler Strasse 30 Haan,D 42781Germany

E-mail:sales@vilsion.com

Middle Eastern

Zarchin 10St.Raanana,43662 Israel

Zarchin 10St.Raanana,43662 Israel

E-mail:peter@vilsion.com

African

65 Oude Kaap, Estates Cnr, Elm & Poplar Streets

Dowerglen,1609 South Africa

E-mail:amy@vilsion.com

Asian

583 Orchard Road, #19-01 Forum,Singapore,

238884 Singapore

238884 Singapore

E-mail:steven@vilsion.com