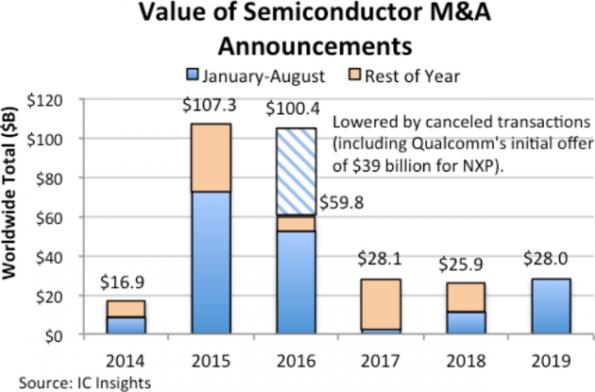

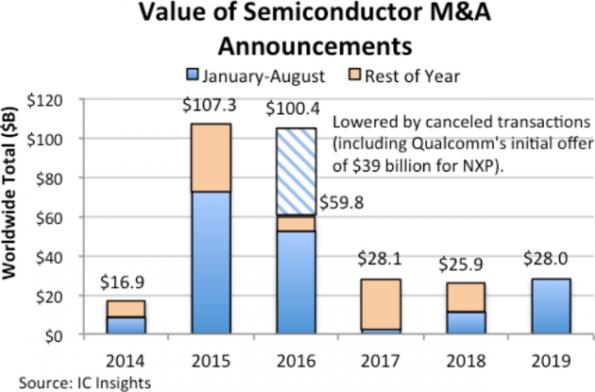

Semiconductor M&A picking up in 2019

This also means that the activity is set to beat that in 2017 but is unlikely to top the spike of action in 2015 and 2016, the market research firm said. The deals include the purchase of whole chip companies, business units, product lines, intellectual property and wafer fabs.

In 2019 the activity has been driven by deals in networking and wireless connectivity ICs and in automotive.

Notable deals include Intel in July 2019 selling its cellphone modem business to Apple (see Report: Apple in talks to buy Intel modem business ) for about $1 billion after the chip giant spent eight years trying to displace Qualcomm in key accounts.

In May 2019, Marvell announced the sale of its Wi-Fi connectivity business to NXP for $1.7 billion (see NXP is buying Marvell's Wi-Fi business for $1.76 billion ). In the same month Marvell said it would acquire Globalfoundries' ASIC business called Avera for $650 million and networking chip company Aquantia for $452 million (see Marvell to acquire GloFo spin-off Avera and Marvell to buy Aquantia to bolster in-car Ethernet ). These moves were intended to move Marvell away from the largely saturated mobile market and towards data center networking and automotive.

There have been a half-dozen semiconductor acquisition announcements in 2019 valued at $1 billion or more, together representing 89 percent of the M&A total so far this year.

One of the reasons for the drop in M&A activity in 2016 and subsequently has been the impact of US-China trade war and regulatory scrutiny.

IC Insights’ list of acquisitions excludes transactions between semiconductor capital equipment suppliers, material producers, chip packaging and testing companies, and design-automation software firms.

In 2019 the activity has been driven by deals in networking and wireless connectivity ICs and in automotive.

Notable deals include Intel in July 2019 selling its cellphone modem business to Apple (see Report: Apple in talks to buy Intel modem business ) for about $1 billion after the chip giant spent eight years trying to displace Qualcomm in key accounts.

In May 2019, Marvell announced the sale of its Wi-Fi connectivity business to NXP for $1.7 billion (see NXP is buying Marvell's Wi-Fi business for $1.76 billion ). In the same month Marvell said it would acquire Globalfoundries' ASIC business called Avera for $650 million and networking chip company Aquantia for $452 million (see Marvell to acquire GloFo spin-off Avera and Marvell to buy Aquantia to bolster in-car Ethernet ). These moves were intended to move Marvell away from the largely saturated mobile market and towards data center networking and automotive.

There have been a half-dozen semiconductor acquisition announcements in 2019 valued at $1 billion or more, together representing 89 percent of the M&A total so far this year.

One of the reasons for the drop in M&A activity in 2016 and subsequently has been the impact of US-China trade war and regulatory scrutiny.

IC Insights’ list of acquisitions excludes transactions between semiconductor capital equipment suppliers, material producers, chip packaging and testing companies, and design-automation software firms.

CONTACT US

USA

Vilsion Technology Inc.

36S 18th AVE Suite A,Brington,Colorado 80601,

United States

E-mail:sales@vilsion.com

Europe

Memeler Strasse 30 Haan,D 42781Germany

E-mail:sales@vilsion.com

Middle Eastern

Zarchin 10St.Raanana,43662 Israel

Zarchin 10St.Raanana,43662 Israel

E-mail:peter@vilsion.com

African

65 Oude Kaap, Estates Cnr, Elm & Poplar Streets

Dowerglen,1609 South Africa

E-mail:amy@vilsion.com

Asian

583 Orchard Road, #19-01 Forum,Singapore,

238884 Singapore

238884 Singapore

E-mail:steven@vilsion.com