Slowing Memory Market Cools Chip Growth

Semiconductor sales growth has slowed substantially in recent months as the rapid price increases that fueled the market's growth for more than two years has slowed to a trickle.

The three-month rolling average for chip sales growth slowed to 13.8% in January, the lowest level since November 2016, according to the World Semiconductor Trade Statistics organization. Sales for the quarter were up 13.8% year-over-year, the lowest rate of growth since the fourth quarter of 2016. In fact, it marked the first time since the first quarter of 2017 that the growth rate slipped below 20%.

The slowing sales growth has corresponded directly with a decline in the growth rate of DRAM and NAND flash memory prices, which have slowed dramatically in recent months as the memory industry shifts from a prolonged period of supply shortage to oversupply.

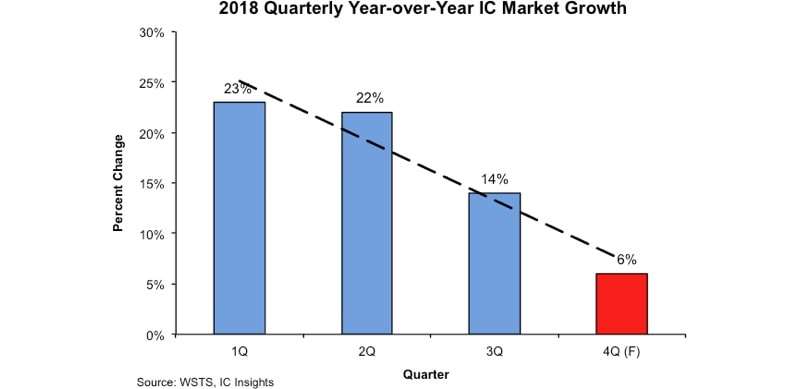

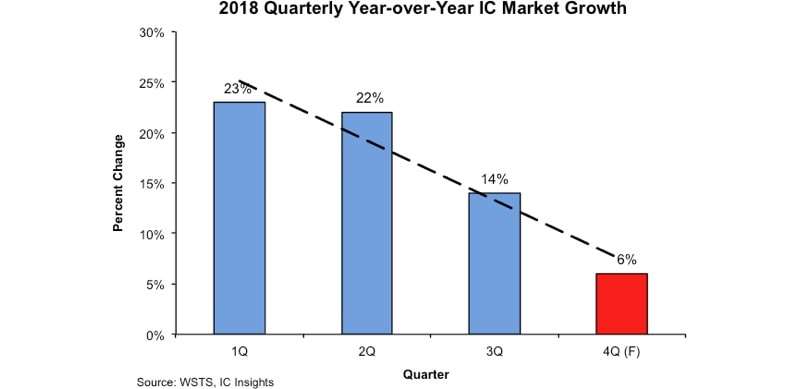

"The softening memory market has started to become a 'headwind' on total IC market growth," said market research firm IC Insights in a recent report. The firm is forecasting that overall chip sales growth will fall to 6% in the fourth quarter.

IC Insights — which forecasts that the semiconductor industry has entered a "cooling period" after a prolonged period of expansion — noted that the memory chip market grew by only 8% in the third quarter compared to the second quarter. By contrast, the firm said, the memory chip market grew by 18% from the second quarter to the third quarter last year.

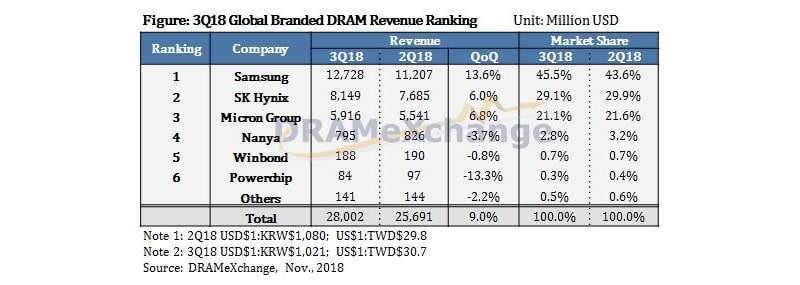

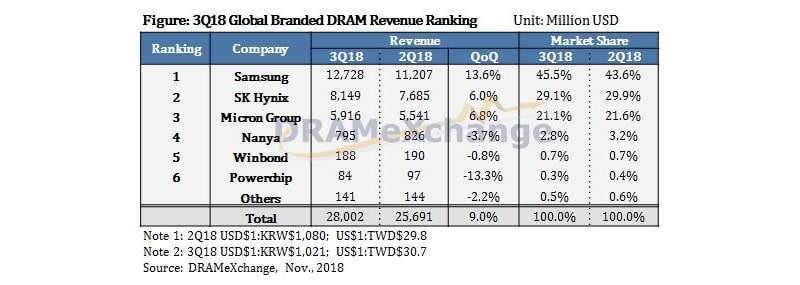

Overall, DRAM sales increased by 9% in the third quarter to again set a new record at $28 billion, according to market research firm TrendForce's DRAMeXchange unit. But the firm said that pricing for mainstream DRAM applications such as PC, server and mobile increased by less than 2% in the quarter. Contract pricing for DDR3 consumer DRAM was the first to drop during the quarter because of weakening demand, while contract pricing for graphics DRAM actually decreased by 3% compared to the second quarter because of the sharp demand for cryptocurrency mining, TrendForce said.

Also concerning is that TrendForce said that DRAM revenue growth in the third quarter was primarily due to increasing bit shipments, rather than rising prices. "Prices practically flattened out in 3Q18 as the market supply has been steadily expanding in the second half of the year," the firm said in a press statement.

TrendForce predicts that DRAM prices, which started to fall in October, will continue to slide through the end of the fourth quarter, officially ending the DRAM boom that lasted for more than two years. Future price declines will be steep because the market has clearly entered an oversupply situation and inventories remain high, the firm said.

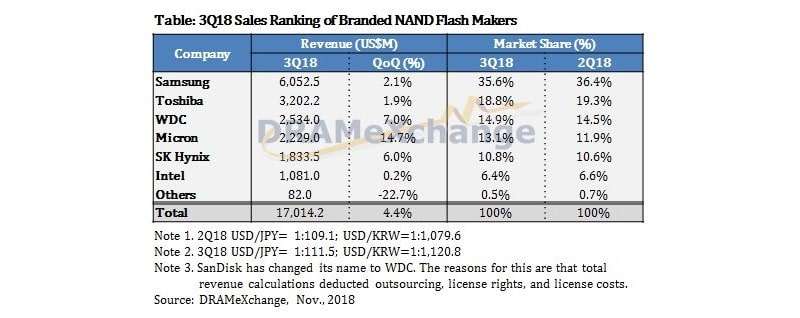

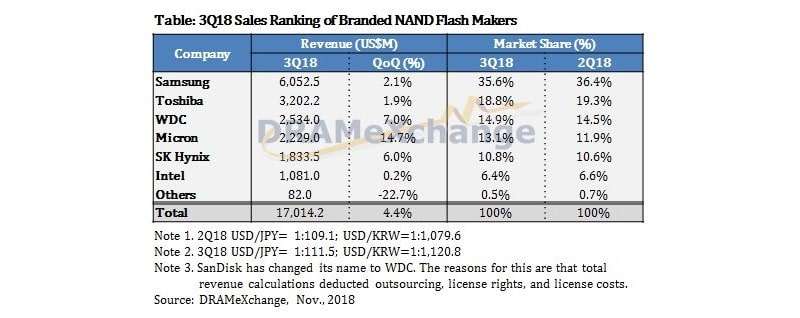

Meanwhile, TrendForce also reported recently that NAND flash revenue grew by just 4.4% in the third quarter compared with the second quarter, with the average selling price of devices falling by 10-15% on a contract basis. The firm maintains that the NAND market has been in oversupply since the start of this year.

“The market for NAND Flash is expected to remain in oversupply during 4Q18, with steeper price decline for various NAND flash products,” said Ben Yeh, a DRAMeXchange analyst, in a statement.

CONTACT US

USA

Vilsion Technology Inc.

36S 18th AVE Suite A,Brington,Colorado 80601,

United States

E-mail:sales@vilsion.com

Europe

Memeler Strasse 30 Haan,D 42781Germany

E-mail:sales@vilsion.com

Middle Eastern

Zarchin 10St.Raanana,43662 Israel

Zarchin 10St.Raanana,43662 Israel

E-mail:peter@vilsion.com

African

65 Oude Kaap, Estates Cnr, Elm & Poplar Streets

Dowerglen,1609 South Africa

E-mail:amy@vilsion.com

Asian

583 Orchard Road, #19-01 Forum,Singapore,

238884 Singapore

238884 Singapore

E-mail:steven@vilsion.com