STTMRAM to lead $4.6B non-volatile memory market in 2021

Non-volatile memory is still limited to niche markets due to limited densities, but this will change in the near future.

Figure 2: (Source: Yole Developpement)

Figure 3: (Source: Yole Developpement)

Due to limited density available, it will take some time before the emerging non-volatile memory reaches its full potential in the market, according to market research firm Yole Développement.

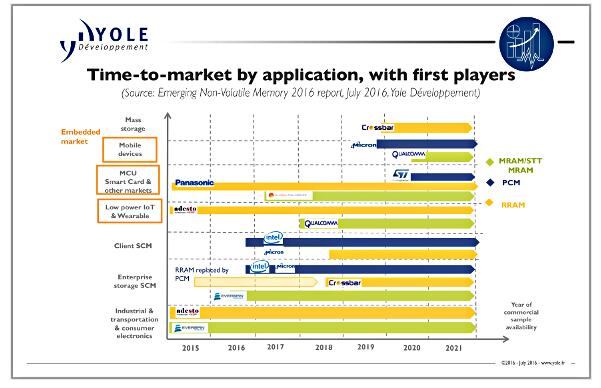

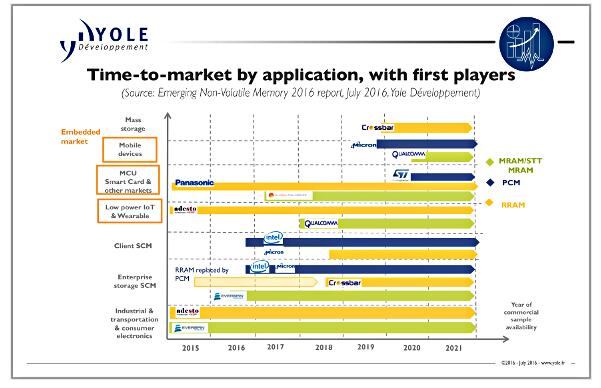

“Higher density products’ introduction have been delayed by MRAM pioneers such as Everspin, Crocus and Avalanche,” said Yann de Charentenay from Yole. “Moreover, Micron/Intel delayed their PCM sales to 2017.”

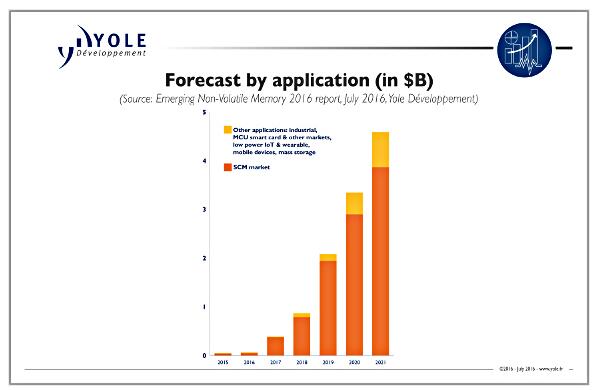

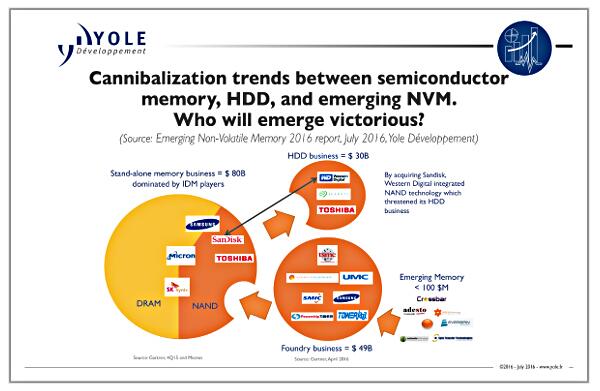

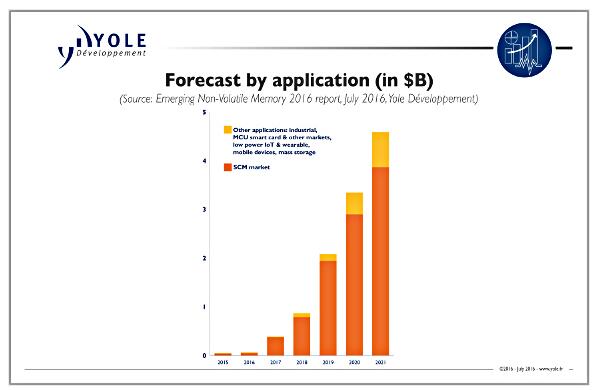

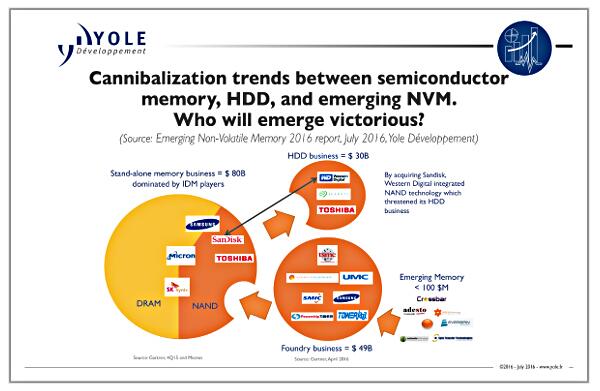

The emerging NVM market in 2015 was thus considerably lower than the dominant volatile DRAM and non-volatile flash memory businesses, which had combined revenues of almost US$80 billion in 2015. However, the global emerging NVM market will soar from US$53 million in 2015 to US$4.6 billion by 2021, exhibiting an impressive growth of 110% per year.

Figure 1: (Source: Yole Developpement)

In 2015, the Micron/Intel alliance presented a breakthrough stand-alone memory product called 3D Xpoint, developed in secret for many years, which uses PCM material instead of RRAM as the industry expected. Thus, after being down and out for a while, PCM made a big comeback in the emerging NVM race. This product has a high density for an emerging NVM (128Gb), which is close to the latest NAND thanks to high node (20nm), a 3D crosspoint structure, and a good selector.

Yole expects PCM will have the largest emerging NVM market share by 2021, thanks to its prominent promoters (Micron/Intel), which have sufficient influence to create a new SCM category using 3D Xpoint in the memory hierarchy. Indeed, creating a new memory category is a sea-change that will require numerous hardware and software developments by all memory ecosystem players. And while there is no general agreement, many experts believe DRAM sales will decrease due to SCM’s increased use. For this reason, many incumbent players, especially DRAM ones, have postponed their SCM product introduction in order to extend their DRAM profits, which over the last several years have been very high.

Figure 2: (Source: Yole Developpement)

“SCM will be the clear go-to market for emerging NVM in 2021,” said de Charentenay. “SCM will be adopted in enterprise storage and client applications, and later in mobile. SCM will greatly enhance systems’ speed and data protection, especially in data centres where traffic will explode in the coming years.”

Customers will use either PCM or RRAM for SCM Storage (S) type applications that require high capacity, and STTMRAM for SCM Memory (M) type applications where high endurance and speed are required.

In the stand-alone market mostly focused on SCM for the next five years, the big players’ technological choices are now quite clear: Micron/Intel have chosen PCM, SK Hynix and Sandisk/Western Digital have selected RRAM as the competitor to PCM for SCM applications, and Samsung seems also to favor RRAM thanks to its compatibility with the vertical 3D approach used for 3D NAND.

Substitution of 3D NAND by RRAM and DRAM by STTMRAM will commence very slowly before 2021, focused in niche applications where price is less sensitive. Indeed, incumbent technologies have found new solutions to further scale down their technologies, as has happened many times in the past.

Figure 3: (Source: Yole Developpement)

Embedded MCUs often use eflash NVM technology, but this technology consumes lots of power and its scalability becomes cost-prohibitive at 28 nm node. With its recent scalability progress, emerging NVM will be increasingly used in low-power IoT and wearable, smart card, and other markets, first at 40nm thanks to its lower power consumption, and then at 28nm thanks to its competitive cost. The big question is, which emerging NVM to choose?

Some early movers like Panasonic and SMIC have selected RRAM, while top foundries (TSMC, GF, Samsung) will propose STTMRAM in 2017-2018, and ST Microelectronics selected PCM for the 28nm node in 2020. But many key players including Renesas, Infineon, Texas Instruments, MicroChip and Cypress have not yet officially chosen.

Considering the trend towards STTMRAM among the foundries, Yole expects STTMRAM will lead the embedded market in 2021. However, thanks to its lower cost, RRAM/PCM could take a larger market share if it is selected by some players.

Keywords:memory

Keywords:memory

CONTACT US

USA

Vilsion Technology Inc.

36S 18th AVE Suite A,Brington,Colorado 80601,

United States

E-mail:sales@vilsion.com

Europe

Memeler Strasse 30 Haan,D 42781Germany

E-mail:sales@vilsion.com

Middle Eastern

Zarchin 10St.Raanana,43662 Israel

Zarchin 10St.Raanana,43662 Israel

E-mail:peter@vilsion.com

African

65 Oude Kaap, Estates Cnr, Elm & Poplar Streets

Dowerglen,1609 South Africa

E-mail:amy@vilsion.com

Asian

583 Orchard Road, #19-01 Forum,Singapore,

238884 Singapore

238884 Singapore

E-mail:steven@vilsion.com